On December 7, the International Civil Aviation Organization (ICAO) celebrates its 80th anniversary. In addition to enabling global connectivity, the organization has been at the forefront of aviation decarbonization through its support of the industry’s net-zero emissions goal by 2050, as well as its aspiration to reduce carbon emissions by 5% for international aviation by 2030 using sustainable aviation fuels (SAF) and other cleaner energy sources.

Boeing supports ICAO’s sustainability efforts and in 2023 the company joined the ICAO Assistance, Capacity-building and Training for Sustainable Aviation Fuels (ACT-SAF) initiative. ACT-SAF creates opportunities for countries to develop their full potential in SAF development and deployment.

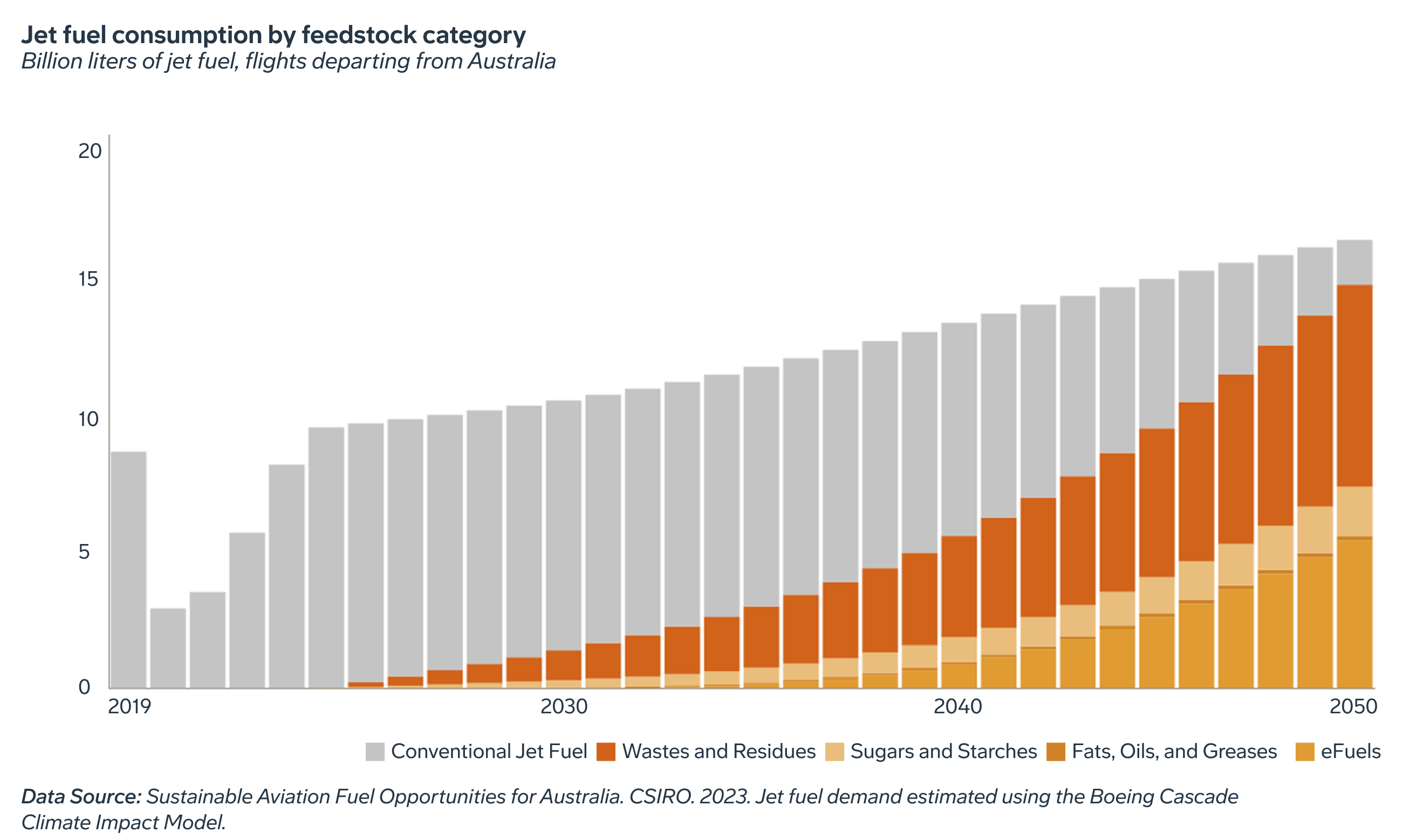

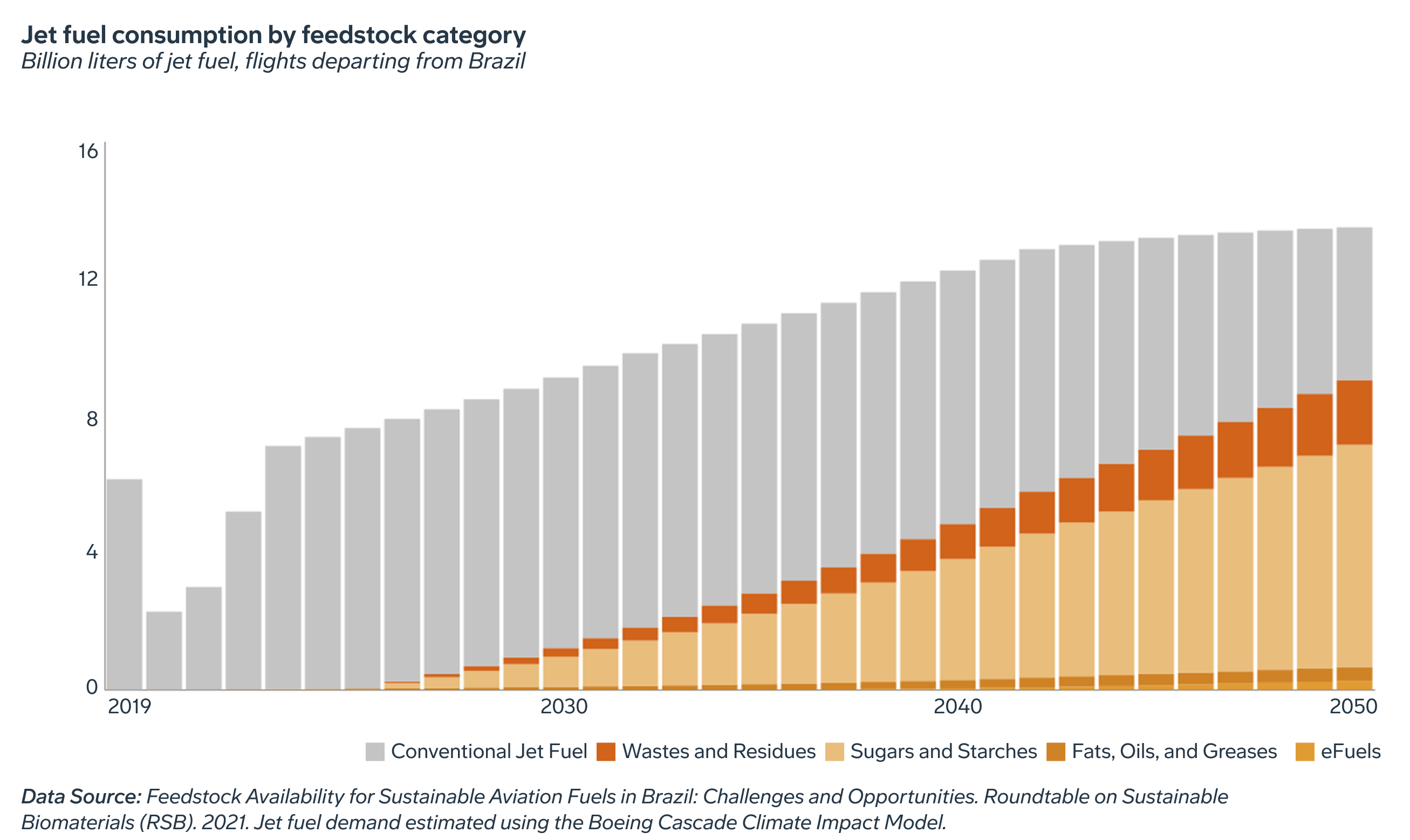

In support of ICAO’s initiative, Boeing has helped develop region-specific roadmaps and SAF feedstock analyses together with local partners to help scale SAF production locally to help meet demand globally. These roadmaps help to identify which feedstocks are the most cost-effective, and politically and technically achievable, in any particular country.

Our studies span the UK, Ireland, India, UAE, Australia & New Zealand, Brazil, South Africa, Ethiopia, Japan and a recently launched SAF feedstock assessment for Southeast Asia.

“These roadmaps inform three things,” said Brian Moran, chief sustainability officer at Boeing. “They inform policy, including incentives and other measures, such as revenue certainty mechanisms that de-risk investment in SAF facilities for producers. They inform technology, and which feedstock and production pathways are the most promising to scale up. And thirdly, they inform financing and opportunity for investors.”